Video-2 Wickless Heiken Ashi

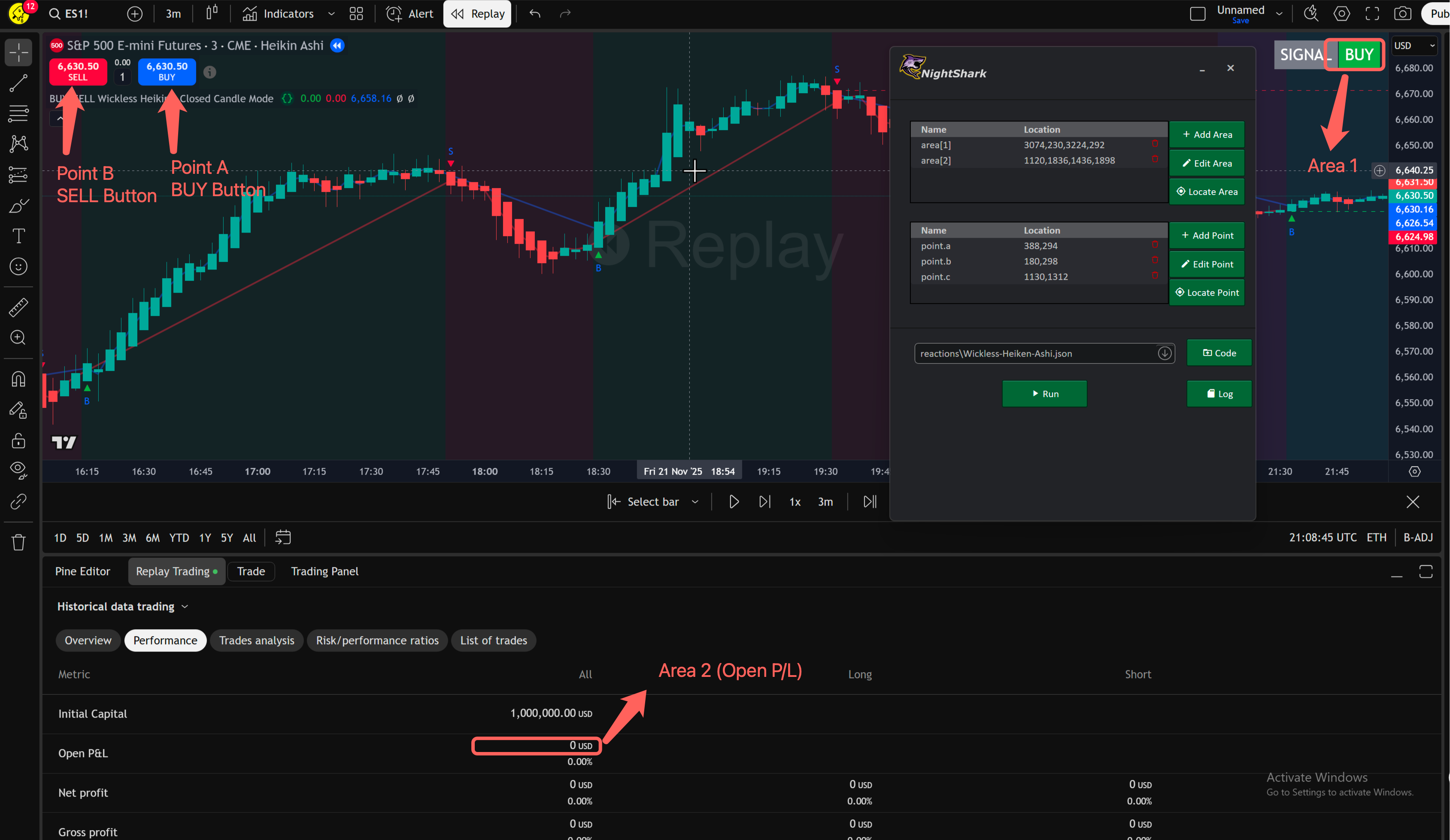

This walkthrough shows how to automate trades by pairing TradingView’s Wickless Heiken Ashi script with NightShark and Tradovate. Copy the Pine Script into TradingView, attach it to a clean chart, and inspect replay signals. Load the NightShark script, map buy, sell, and neutral zones, then mirror orders to Tradovate while considering risk controls and expanded monitoring for ongoing insights.

YouTube Video

Screen Map

Indicator Code

//@version=6

indicator("BUY/SELL Wickless Heikin – Closed Candle Mode", overlay = true)

calculate_heikin_ashi() =>

var float ha_open = 0.0

ha_close = (open + high + low + close) / 4

ha_open := na(ha_open[1]) ? (open + close) / 2 : (ha_open[1] + ha_close[1]) / 2

ha_high = math.max(high, math.max(ha_open, ha_close))

ha_low = math.min(low, math.min(ha_open, ha_close))

[ha_open, ha_close, ha_high, ha_low]

[haOpen, haClose, haHigh, haLow] = calculate_heikin_ashi()

// ===============================

// Inputs

// ===============================

maxBullLowerWickPct = input.float(1.0, "Max lower wick for Bull (%)", minval = 0.0, maxval = 5.0, step = 0.1)

maxBearUpperWickPct = input.float(1.0, "Max upper wick for Bear (%)", minval = 0.0, maxval = 5.0, step = 0.1)

lockModeEnabled = input.bool(true, "Enable one-shot lock mode")

showExtendedLines = input.bool(true, "Show extended lines")

anchorOffsetBars = input.int(0, "Anchor offset (bars)", minval = 0, maxval = 50)

bullLineColor = input.color(color.new(color.lime, 0), "Bull line color")

bearLineColor = input.color(color.new(color.red, 0), "Bear line color")

// ===============================

// Tolerances

// ===============================

haBarRange = math.max(haHigh - haLow, 0.0)

epsilonTick = syminfo.mintick * 0.5

lowerWickTolerance = haBarRange * (maxBullLowerWickPct / 100.0) + epsilonTick

upperWickTolerance = haBarRange * (maxBearUpperWickPct / 100.0) + epsilonTick

// Raw Signals (same logic)

isHeikinAshiBullish = haClose >= haOpen

isHeikinAshiBearish = haClose < haOpen

hasNoLowerWickWithinTolerance = math.min(haOpen, haClose) - haLow <= lowerWickTolerance

hasNoUpperWickWithinTolerance = haHigh - math.max(haOpen, haClose) <= upperWickTolerance

rawBullSignal = isHeikinAshiBullish and hasNoLowerWickWithinTolerance

rawBearSignal = isHeikinAshiBearish and hasNoUpperWickWithinTolerance

conflictingSignals = rawBullSignal and rawBearSignal

// ===============================

// Lock regime + triggers (closed bars only)

// ===============================

var int lockRegime = 0

var bool bullTrigger = false

var bool bearTrigger = false

if barstate.isconfirmed

bullTrigger := (lockModeEnabled ? (rawBullSignal and lockRegime != 1) : rawBullSignal) and not conflictingSignals

bearTrigger := (lockModeEnabled ? (rawBearSignal and lockRegime != -1) : rawBearSignal) and not conflictingSignals

if lockModeEnabled

if bullTrigger

lockRegime := 1

else if bearTrigger

lockRegime := -1

// ===============================

// Last Signal Levels (closed bar only)

// ===============================

var float lastBullLevel = na

var float lastBearLevel = na

if barstate.isconfirmed

if bullTrigger

lastBullLevel := haOpen

if bearTrigger

lastBearLevel := haOpen

// ===============================

// Extended Lines

// ===============================

var line bullExtLine = line.new(na, na, na, na, color = bullLineColor, style = line.style_dashed, extend = extend.right)

var line bearExtLine = line.new(na, na, na, na, color = bearLineColor, style = line.style_dashed, extend = extend.right)

line.set_extend(bullExtLine, showExtendedLines ? extend.right : extend.none)

line.set_extend(bearExtLine, showExtendedLines ? extend.right : extend.none)

if barstate.isconfirmed and showExtendedLines and bullTrigger and not na(lastBullLevel)

anchorX1 = bar_index - anchorOffsetBars

line.set_xy1(bullExtLine, anchorX1, lastBullLevel)

line.set_xy2(bullExtLine, anchorX1 + 1, lastBullLevel)

if barstate.isconfirmed and showExtendedLines and bearTrigger and not na(lastBearLevel)

anchorX1 = bar_index - anchorOffsetBars

line.set_xy1(bearExtLine, anchorX1, lastBearLevel)

line.set_xy2(bearExtLine, anchorX1 + 1, lastBearLevel)

// ===============================

// Plot BUY/SELL

// ===============================

plotshape(bullTrigger, title = "Bull", style = shape.triangleup, location = location.belowbar, color = color.green, size = size.tiny, text = "B")

plotshape(bearTrigger, title = "Bear", style = shape.triangledown, location = location.abovebar, color = color.red, size = size.tiny, text = "S")

// ===============================

// Regime background

// ===============================

bg = lockModeEnabled ? (lockRegime == 1 ? color.new(color.green,92) : lockRegime == -1 ? color.new(color.red,92) : na) : na

bgcolor(bg)

// ===============================

// Trend classification for signal table

// ===============================

bullish = lockModeEnabled ? lockRegime == 1 : bullTrigger

bearish = lockModeEnabled ? lockRegime == -1 : bearTrigger

exit = not bullish and not bearish

signal = bullish ? "BUY" : bearish ? "SELL" : exit ? "EXIT" : "NONE"

baseLine = na(haClose) ? close : haClose

// Wave fill

pBull = plot(bullish ? baseLine : na, title = "Bull Wave", color = color.new(color.blue, 60), linewidth = 2)

pBear = plot(bearish ? baseLine : na, title = "Bear Wave", color = color.new(color.red, 60), linewidth = 2)

fill(pBull, pBear, color = bullish ? color.new(color.blue,70) : color.new(color.red,70))

// Trend-change dot

var int os = na

os := bullish ? 1 : bearish ? 0 : os[1]

plot(os != os[1] ? baseLine : na, title = "Trend Change", style = plot.style_circles, linewidth = 3, color = os == 1 ? color.blue : color.red)

// ===============================

// Top-right signal table

// ===============================

var table signalTable = table.new(position.top_right, 2, 1, border_width = 1)

bgColor = bullish ? color.green : bearish ? color.red : exit ? color.orange : color.white

textColor = (bullish or bearish or exit) ? color.white : color.black

table.cell(signalTable, 0, 0, "SIGNAL", text_color = color.white, text_size = size.large, bgcolor = color.gray)

table.cell(signalTable, 1, 0, signal, text_color = textColor, text_size = size.large, bgcolor = bgColor)

Nightshark Code

global TakeProfit := 500 ;This is your take profit level

global StopLoss := -500 ; This is your stop loss level

Skip_First_signal := true ; Set to true to skip the first signal after starting the script

BUY_Condition() {

return area[1] ~= "BUY"

}

SELL_Condition() {

return area[1] ~= "SELL"

}

PnL_Exit(openPL) {

return openPL >= TakeProfit || openPL <= StopLoss

}

click(point.c)

if(Skip_First_signal) {

read_areas()

if (BUY_Condition()) {

Log("Skipping first BUY signal, waiting for SELL signal")

loop{

read_areas()

} Until (SELL_Condition())

}

else if (SELL_Condition()) {

Log("Skipping first SELL signal, waiting for BUY signal")

loop{

read_areas()

} Until (BUY_Condition())

}

}

loop

{

Log("Waiting for BUY or SELL signal...")

loop {

read_areas()

sleep 100 ; reduce polling CPU usage

} until (BUY_Condition() || SELL_Condition())

if (BUY_Condition()) {

Log("BUY signal detected ! Entered Long Position")

click(point.a)

sleep 500

click(point.c)

loop {

read_areas()

openPL := toNumber(area[2])

openPL += 0

} until (SELL_Condition() || PnL_Exit(openPL))

if(SELL_Condition()) {

Log("Long Closed due to SELL condition")

}

else if(PnL_Exit(openPL)) {

Log("Long Closed due to PnL Exit: " + openPL)

Log("==on Hold until new SELL signal==")

loop {

read_areas()

sleep 100 ; reduce polling CPU usage

} Until SELL_Condition()

}

click(point.b)

sleep 500

click(point.c)

}

else if (SELL_Condition()) {

Log("SELL signal detected ! Entered SHORT Position")

click(point.b)

sleep 500

click(point.c)

loop {

read_areas()

openPL := toNumber(area[2])

openPL += 0

} until (BUY_Condition() || PnL_Exit(openPL) )

if(BUY_Condition()) {

Log("Short Closed due to BUY condition")

}

else if(PnL_Exit(openPL)) {

Log("Short Closed due to PnL Exit: " + openPL)

Log("== on Hold until new BUY signal ==")

loop {

read_areas()

sleep 100 ;reduce polling CPU usage

} Until BUY_Condition()

}

click(point.a)

sleep 500

click(point.c)

}

}