Video-4 Mean Reversion

This walkthrough demonstrates a mean reversion strategy automated with NightShark. By detecting overextended price movements using custom mean reversion indicators on TradingView, we trigger automated entries and exits on Tradovate. The setup leverages NightShark's advanced risk management tools—including trailing open P/L stops and daily loss limits—to protect capital while capturing mean-reverting moves.

YouTube Video

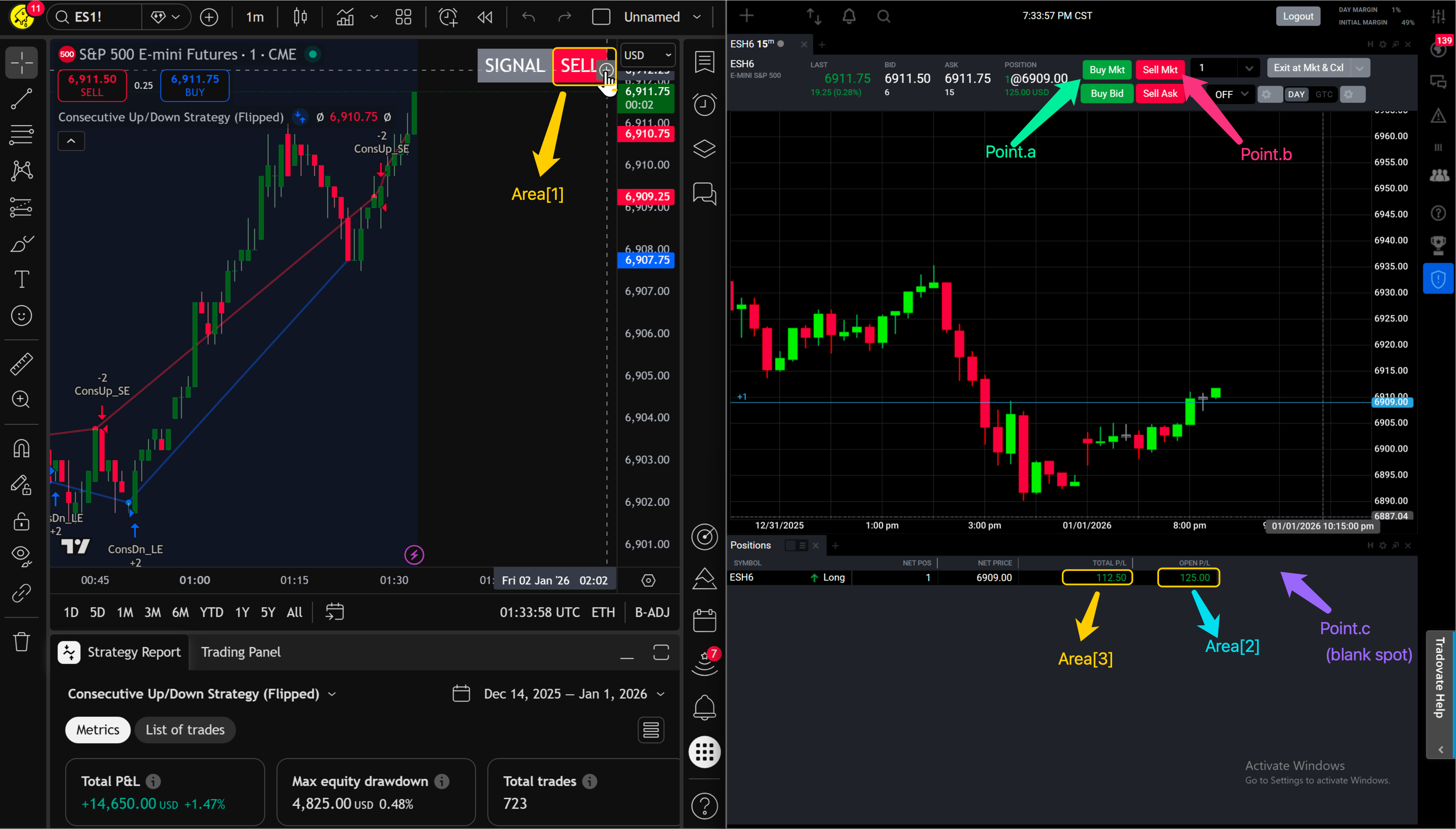

Screen Map

Indicator Code

//@version=6

strategy("Consecutive Up/Down Strategy (Flipped)", overlay=true)

// Inputs

consecutiveBarsUp = input.int(3, "Consecutive bars up")

consecutiveBarsDown = input.int(3, "Consecutive bars down")

// Price

price = close

// Count consecutive up bars

ups = 0.0

ups := price > price[1] ? nz(ups[1]) + 1 : 0

// Count consecutive down bars

dns = 0.0

dns := price < price[1] ? nz(dns[1]) + 1 : 0

// FLIPPED ENTRIES

if ups >= consecutiveBarsUp

strategy.entry("ConsUp_SE", strategy.short)

if dns >= consecutiveBarsDown

strategy.entry("ConsDn_LE", strategy.long)

// Signal logic

bullish = dns >= consecutiveBarsDown

bearish = ups >= consecutiveBarsUp

exit = false

signal = bullish ? "BUY" : bearish ? "SELL" : exit ? "EXIT" : "NONE"

// Baseline

baseLine = close

// Wave-style fills

pBull = plot(bullish ? baseLine : na, title="Bull Wave", color=color.new(color.blue, 60), linewidth=2)

pBear = plot(bearish ? baseLine : na, title="Bear Wave", color=color.new(color.red, 60), linewidth=2)

fill(pBull, pBear, color=bullish ? color.new(color.blue, 70) : color.new(color.red, 70))

// Trend-change dots

var int os = na

os := bullish ? 1 : bearish ? 0 : os[1]

plot(os != os[1] ? baseLine : na, title="Trend Change", style=plot.style_circles, linewidth=3, color=os == 1 ? color.blue : color.red)

// Top-right signal table

var table signalTable = table.new(position.top_right, 2, 1, border_width=1)

bgColor = bullish ? color.new(color.green, 0) : bearish ? color.new(color.red, 0) : exit ? color.new(color.orange, 0) : color.new(color.white, 0)

textColor = (bullish or bearish or exit) ? color.white : color.black

table.cell(signalTable, 0, 0, "SIGNAL", text_color=color.white, text_size=size.large, bgcolor=color.gray)

table.cell(signalTable, 1, 0, signal, text_color=textColor, text_size=size.large, bgcolor=bgColor)

// Repainting detection

hasLookahead = false

hasFutureRef = false

usesFuture = false

repainting = hasLookahead or hasFutureRef or usesFuture

Nightshark Code

global daily_offset := 600

global open_offset := 150

BUY_condition() {

return area[1]~= "BUY"

}

SELL_condition() {

return area[1] ~= "SELL"

}

daily_trail(num) {

if (num > 0) {

return num-daily_offset

}

else {

return -daily_offset

}

}

open_trail(num) {

if (num > 0) {

return num-open_offset

}

else {

return -open_offset

}

}

dailyMax := 0

loop {

openMax := 0

Log("waiting for BUY or SELL signal")

loop {

read_areas()

} until (BUY_condition() || SELL_condition())

if (BUY_condition()) {

Log("BUY condition detected !!")

click(point.a)

click(point.c)

Log("Entered Long ! Waiting for exit condition")

NewOpenSL := -open_offset

loop{

read_areas()

if(toNumber(area[2]) > openMax) {

openMax := toNumber(area[2])

NewOpenSL := open_trail(openMax)

Log("New openMax: " . openMax . " new open SL: " . NewopenSL)

}

if(toNumber(area[3]) > dailyMax) {

dailyMax := toNumber(area[3])

NewDailySL := daily_trail(dailyMax)

Log("New dailyMax: " . dailyMax . " new daily SL: " . NewDailySL)

}

} until (SELL_condition() || toNumber(area[2]) < NewOpenSL || toNumber(area[3]) < NewDailySL)

ExitReason:= SELL_Condition() ? "Exited due to SELL signal" : toNumber(area[2]) < NewOpenSL ? "Exiting cause of openSL" : toNumber(area[3]) < NewDailySL ? "reached Daily limit" : ""

Log(ExitReason)

click(point.b)

click(point.c)

Log("Exited Long")

if(toNumber(area[3]) < NewDailySL) {

Log("Stopping Script due to DailyLimit")

StopCode()

}

}

else if (SELL_condition()) {

Log("Sell Condition Exited")

click(point.b)

click(point.c)

Log("Entered SHORT position")

NewOpenSL := -open_offset

loop{

read_areas()

if(toNumber(area[2]) > openMax) {

openMax := toNumber(area[2])

NewOpenSL := open_trail(openMax)

Log("New openMax: " . openMax . " new open SL: " . NewopenSL)

}

if(toNumber(area[3]) > dailyMax) {

dailyMax := toNumber(area[3])

NewDailySL := daily_trail(dailyMax)

Log("New dailyMax: " . dailyMax . " new daily SL: " . NewDailySL)

}

} until (BUY_condition() || toNumber(area[2]) < NewOpenSL || toNumber(area[3]) < NewDailySL)

ExitReason := BUY_Condition() ? "Exited due to SELL signal" : toNumber(area[2]) < NewOpenSL ? "Exiting cause of openSL" : toNumber(area[3]) < NewDailySL ? "reached Daily SL" : ""

Log(ExitReason)

click(point.a)

click(point.c)

Log("Exited SHORT")

if(toNumber(area[3]) < NewDailySL) {

Log("Stopping Script due to DailyLimit")

StopCode()

}

}

}