Video-3 SuperTrend

This walkthrough shows how to automate trades by pairing TradingView’s SuperTrend script with NightShark and Tradovate. Copy the Pine Script into TradingView, attach it to a clean chart, and inspect replay signals. Load the NightShark script, map buy, sell, and neutral zones, then mirror orders to Tradovate while considering risk controls and expanded monitoring for ongoing insights.

YouTube Video

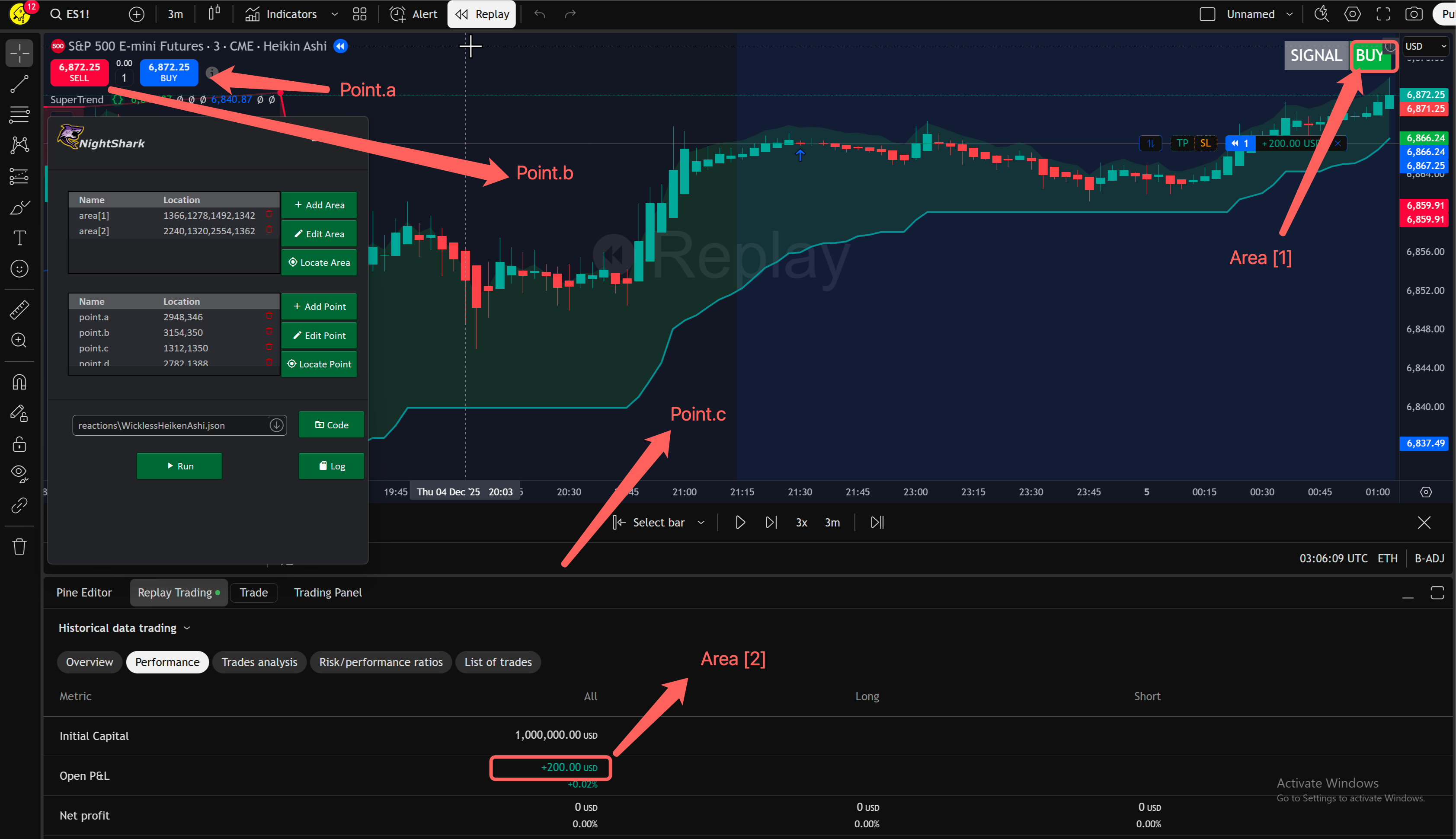

Screen Map

Logic Flowchart

Indicator Code

//@version=6

// Copyright (c) 2019-present, Alex Orekhov (everget)

// Enhanced by ProcessOverProfit

// SuperTrend script may be freely distributed under the terms of the GPL-3.0 license.

indicator("SuperTrend", overlay = true)

const string calcGroup = "Calculation"

length = input.int(22, title = "ATR Period", group = calcGroup)

mult = input.float(3, step = 0.1, title = "ATR Multiplier", group = calcGroup)

src = input.source(hl2, title = "Source", group = calcGroup)

wicks = input.bool(true, title = "Take Wicks into Account", group = calcGroup)

const string visualGroup = "Visuals"

showLabels = input.bool(true, title = "Show Buy/Sell Labels", group = visualGroup)

highlightState = input.bool(true, title = "Highlight State", group = visualGroup)

//---

atr = mult * ta.atr(length)

highPrice = wicks ? high : close

lowPrice = wicks ? low : close

doji4price = open == close and open == low and open == high

longStop = src - atr

longStopPrev = nz(longStop[1], longStop)

if longStop > 0

if doji4price

longStop := longStopPrev

longStop

else

longStop := lowPrice[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

longStop

else

longStop := longStopPrev

longStop

shortStop = src + atr

shortStopPrev = nz(shortStop[1], shortStop)

if shortStop > 0

if doji4price

shortStop := shortStopPrev

shortStop

else

shortStop := highPrice[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

shortStop

else

shortStop := shortStopPrev

shortStop

var int dir = 1

dir := dir == -1 and highPrice > shortStopPrev ? 1 : dir == 1 and lowPrice < longStopPrev ? -1 : dir

const color textColor = color.white

const color longColor = color.green

const color shortColor = color.red

const color longFillColor = color.new(color.green, 85)

const color shortFillColor = color.new(color.red, 85)

longStopPlot = plot(dir == 1 ? longStop : na, title = "Long Stop", style = plot.style_linebr, linewidth = 2, color = longColor)

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title = "Long Stop Start", location = location.absolute, style = shape.circle, size = size.tiny, color = longColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title = "Short Stop", style = plot.style_linebr, linewidth = 2, color = shortColor)

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title = "Short Stop Start", location = location.absolute, style = shape.circle, size = size.tiny, color = shortColor)

midPricePlot = plot(ohlc4, title = "", display = display.none, editable = false)

fill(midPricePlot, longStopPlot, title = "Long State Filling", color = (highlightState and dir == 1 ? longFillColor : na))

fill(midPricePlot, shortStopPlot, title = "Short State Filling", color = (highlightState and dir == -1 ? shortFillColor : na))

// Standardized signal logic

bullish = dir == 1

bearish = dir == -1

exit = false

signal = bullish ? "BUY" : bearish ? "SELL" : exit ? "EXIT" : "NONE"

// Baseline for visualization

superTrend = dir == 1 ? longStop : shortStop

baseLine = na(superTrend) ? close : superTrend

// Wave-style fills

pBull = plot(bullish ? baseLine : na, title = "Bull Wave", color = color.new(color.blue, 60), linewidth = 2)

pBear = plot(bearish ? baseLine : na, title = "Bear Wave", color = color.new(color.red, 60), linewidth = 2)

fill(pBull, pBear, color = bullish ? color.new(color.blue, 70) : color.new(color.red, 70))

// Trend-change dots

var int os = na

os := bullish ? 1 : bearish ? 0 : os[1]

plot(os != os[1] ? baseLine : na, title = "Trend Change", style = plot.style_circles, linewidth = 3, color = os == 1 ? color.blue : color.red)

// Top-right signal table

var table signalTable = table.new(position.top_right, 2, 1, border_width = 1)

bgColor = bullish ? color.new(color.green, 0) : bearish ? color.new(color.red, 0) : exit ? color.new(color.orange, 0) : color.new(color.white, 0)

textColorSignal = (bullish or bearish or exit) ? color.white : color.black

table.cell(signalTable, 0, 0, "SIGNAL", text_color = color.white, text_size = size.large, bgcolor = color.gray)

table.cell(signalTable, 1, 0, signal, text_color = textColorSignal, text_size = size.large, bgcolor = bgColor)

// Repainting detection

hasLookahead = false

hasFutureRef = false

usesFuture = false

repainting = hasLookahead or hasFutureRef or usesFuture

// Bottom-right repainting disclosure

if repainting

var table warningTable = table.new(position.bottom_right, 1, 1)

table.cell(warningTable, 0, 0,"This indicator may repaint.\nBacktesting may be inaccurate.",text_color = color.red,text_size = size.large,bgcolor = color.new(color.white, 80))

Nightshark Code

Skip_First_signal := true ; Set to true to skip the first signal after starting the script

BUY_Condition() {

return area[1] ~= "BUY"

}

SELL_Condition() {

return area[1] ~= "SELL"

}

click(point.c)

if(Skip_First_signal) {

read_areas()

if (BUY_Condition()) {

Log("Skipping first BUY signal, waiting for SELL signal")

loop{

read_areas()

} Until (SELL_Condition())

}

else if (SELL_Condition()) {

Log("Skipping first SELL signal, waiting for BUY signal")

loop{

read_areas()

} Until (BUY_Condition())

}

}

loop

{

Log("Waiting for BUY or SELL signal...")

loop {

read_areas()

sleep 100 ; reduce polling CPU usage

} until (BUY_Condition() || SELL_Condition())

if (BUY_Condition()) {

Log("BUY signal detected ! Entered Long Position")

click(point.a)

sleep 500

click(point.c)

loop {

read_areas()

} until (SELL_Condition())

Log("Long Closed due to SELL condition")

click(point.b)

sleep 500

click(point.c)

}

else if (SELL_Condition()) {

Log("SELL signal detected ! Entered SHORT Position")

click(point.b)

sleep 500

click(point.c)

loop {

read_areas()

} until (BUY_Condition() )

Log("Short Closed due to BUY condition")

click(point.a)

sleep 500

click(point.c)

}

}